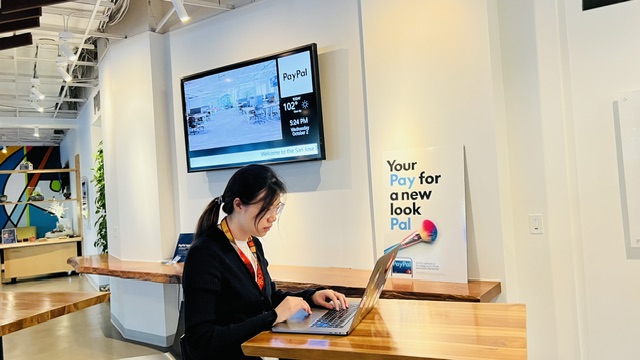

How Keyu Chen Helped to Ensure International Legal Compliance for PayPal

PayPal is a massive global entity in regard to payment processing. With all of the success this company has experienced, the potential complications are numerous. Staying in compliance with federal laws is both a requirement and is precarious due to its complexity. One of the many areas PayPal must navigate is adherence to the stipulations of embargos. One of the companies most valuable assets for this has been Keyu Chen, the Machine Learning Scientist and Engineer who has been so prominent in many of the technological advancements for the guideline adherence of this company. A highly revered leader and innovator in the field, Ms. Chen has devised an innovative fine-tuned text-based model utilizing a state-of-the-art Generative AI model known as LLaMA2 – Large Language Model Architecture. This creation of this PEP PS SCM (Politically Exposed Person, Profile Screening, Sanction Case Management) Model has taken the guesswork out of what does and doesn’t meet the purchases stipulated in embargos, allowing PayPal to breathe easier.

The world is one large global market in which giant corporations and individual consumers everywhere have access to goods and services from anywhere. This also means that the opportunity for “bad actors” to provide misleading data or execute unauthorized purchases. To negate this and protect PayPal from unwittingly being an accomplice to these sorts of purchases, Keyu’s PEP PS SCM Model is designed to enhance PayPal’s ability to comply with economic sanctions and political watchlists, including those managed by the Office of Foreign Assets Control (OFAC). These lists include individuals and entities such as terrorists, narcotics traffickers, and other sanctioned groups that the U.S. government prohibits from conducting financial transactions. Given PayPal’s global presence, it was crucial to design the model to handle multilingual data. This aspect of the project was indeed challenging, as it required incorporating multi-language NLP models that could understand nuances in text across different languages.

The use of AI in this model was essential in making it light years more effective and efficient than prior tactics. Keyu explains, “The machine leverages AI, particularly the LLaMA2-based NLP model, to search for keywords, patterns, and context within transaction data. What makes the AI effective is its ability to go beyond simple keyword matching. Rather than the approach of traditional systems which would flag a transaction based solely on the presence of certain keywords (e.g., names of sanctioned entities or products related to embargoes) my model analyzes the context in which these keywords appear, distinguishing between benign uses of the words and genuinely suspicious activity. The model is designed with a highly tuned ability to recognize patterns and connections that might not be obvious to human reviewers. For example, it can detect complex networks of transactions that seem unrelated on the surface but are linked by geographical locations, circular payments, or structured amounts intended to bypass regulatory thresholds. By integrating graph-based variables and contextual data, the model can emulate how a human investigator might approach a case. It analyzes not only the transaction itself but also the relationships between the parties involved, which is often where money laundering or sanctioned activities are hidden. In essence, the model performs a sophisticated analysis that enables it to detect potential violations far more efficiently than human agents could alone. It filters out noise and highlights the truly suspicious activities, significantly reducing the workload of manual investigators.

The effects of the PEP PS SCM Model is dramatic in numerous ways. Necessary human resources were reduced while accuracy was remarkably increased. Genuinely suspicious activity became easier to locate while false positives took a sizeable downtick. Pleased with these results, Keyu Chen emphasizes, “Perhaps most gratifying was knowing that the model contributed to protecting the integrity of the U.S. financial system and thwarting illicit activities like money laundering and terrorist financing was incredibly rewarding. Financial crimes pose a significant threat to global security, and the model I created played a vital role in helping to prevent these activities.”

Writer : Winston Scott